But grow in grace and in the knowledge of our Lord and Saviour Jesus Christ. To him be glory both now and forever. Amen.

2 Peter 3:18

Hyperinflation Survival Guide

And the LORD hath blessed my master greatly; and he is become great: and he hath given him flocks, and herds, and silver, and gold, and menservants, and maidservants, and camels, and asses. Genesis 24:35 (Emphasis mine)

The LORD blessed Abraham with silver and gold (and everything else he needed) because Abraham put the LORD first in tithes and offerings (read Genesis, chapter 14 and Hebrews, chapter 7 for details). Our Lord Jesus instructs us to lay up treasure in heaven, not on earth.

If we put the LORD first in tithes and offerings to support a Bible-believing Church, Christian Missionaries and give extra to the poor, then we are laying up treasure in heaven. And God promises to meet our needs here on earth.

Silver and gold are not evil. But the love of money is evil. People who are willing to break any of the Ten Commandments in order to get more money, love money. Yet, others, like Abrabham, would not steal, lie, kill, or prostitute himself for money. He loved God and his neighbor, not money. And God blessed Abraham with silver and gold.

Our Lord Jesus taught us to be faithful even in the "unrighteous mammon". To be faithful in money, we need to understand paper money. We also need to understand inflation and its relationship to silver and gold.

PAPER MONEY

Throughout history, men have traded things that they valued. It could be cattle (good for dairy and meat) or horses (good for transportation and war) or silver and gold (good for jewelry and temple artwork, whether Hebrew or pagan).

Paper money was a more recent development. Paper money was originally a "note" (an I.O.U.) for something of value (such as silver or gold). Paper money could be traded for silver or gold upon demand. Paper money was easier to carry and store than large amounts of silver and gold coins.

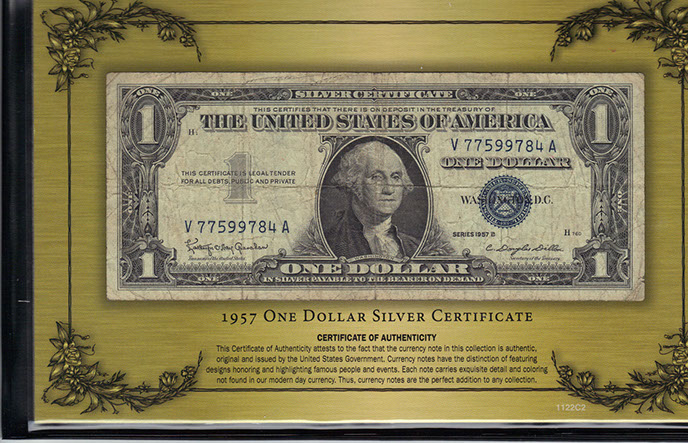

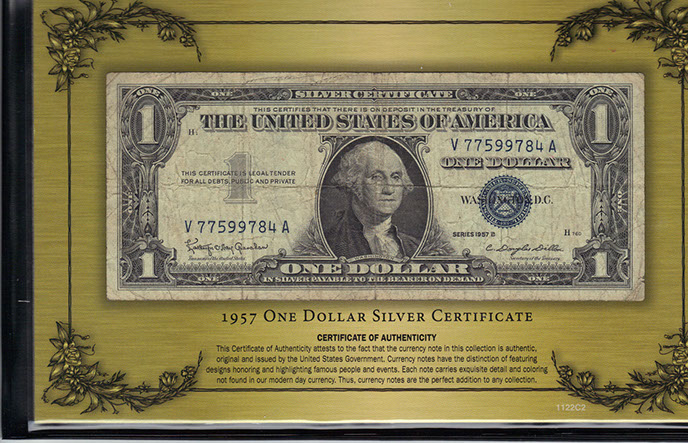

For example, below is a picture of an official 1957 $1 U.S. Silver Certificate.

Introduced by an Act of Congress in 1878, Silver Certificates were backed by silver held by the U.S. Treasury and were redeemable by $1 of Silver Bullion.

Today our dollars do not have the words "Silver Certificate" printed on the top. They are no longer redeemable in silver. The promise below Washington's portrait is no longer honored.

When banks and governments issued paper money, they soon realized that not everyone demanded silver and gold coins for paper money. So some banks and governments began to print more paper money than they could actually back by silver and gold coins.

Why print more paper money? The reason was that the banks and governments could spend more. Whenever a few souls grew suspicious of the bank or government, they demanded silver and/or gold coins in exchange for the paper money.

As long as only a few demanded hard money for paper money, the bank or government that issued the paper money could pay the silver and gold coins upon demand. But if too many people demanded silver or gold in exchange for paper money, the bank might run out of silver and gold.

Whenever such a "run on the bank" occurred, the banks usually collapsed or the government declared a "banking holiday" and temporarily closed the banks to the public.

Several times in modern history, some banks and governments have decided to print paper money backed by nothing else than the "good faith and credit" of the bank or government. This has always led to disaster.

INFLATION

Inflation is an increase in the money supply. It is caused both by the printing of unbacked paper money and by the digital creation of money by a central bank. Fiat money (money created out of nothing) is a legalized fraud. It has always led to inflation in the past.

Inflation is also caused by debt and the extension of credit based on fractional reserve banking. Banks lend more than they have, creating more money out of nothing. Borrowers spend the money the bank created, pumping even more money into the economy.

Inflation causes an increase in both prices and wages. It also causes a decrease in the value of each “note” (unit of money) such as the American Dollar.

More dollars chasing basically the same amount of goods and services allows vendors to charge more dollars and workers to demand more dollars. But as prices rise, each dollar buys less and less. People on fixed incomes, such as the elderly and the disabled, are the hardest hit by inflation.

HYPERINFLATION

As the Federal Reserve continues to create money out of thin air at record rates, inflation will soon become hyperinflation. What are the results of hyperinflation?

Your savings and investments, in terms of paper dollars, will be wiped out!! So will your ability to buy even the most basic necessities with paper money.

It happened in Weimar Germany after World War I and in China after World War II. More recently, it happened in Argentina, Brazil, Russia, Yugoslavia and Zimbabwe. It can, and will, happen in America.

Silver and gold have value in areas such as jewelry, electronics and dentistry. Paper money has no intrinsic value, unless backed by something of value, such as gold or silver.

The U.S. Dollar is no longer backed by gold or silver. It has not been on the gold standard for decades.

As the purchase value of paper money goes down, the dollar price of gold and silver tends to go up (though not always in a straight line--there are some sell-offs and pull backs in the price of silver and gold, from time to time).

Yet, over the long term, as the buying power of paper money declines, the dollar value of gold and silver tends to rise. Those who understand this buy gold and silver.

Buy American Gold Eagles -- they are legal tender U.S. gold bullion coins.

CAN'T AFFORD GOLD?

Can't afford gold? Buy silver. American Silver Eagles and pre-1964 90% Silver Coin Bags are a good place to start. Both are legal tender in the USA.

They will be good barter items when the paper dollar loses all remaining value. You can start small by buying a roll of 100 pre-1964 dimes and/or 20 pre-1964 half dollars. After 1963, only Kennedy half dollars contained 90% silver, and only those Kennedy halves minted in 1964.

The Kennedy Half Dollar 1964 BU (Bright Uncirculated) is also a good way to buy silver. Your local coin dealer is often a good way to go for small purchases of silver.

Silver coins cost more than their face value, due to the value of their silver content. This shows what an increase in the money supply has done since 1964. A pre-1965 half dollar silver coin is selling at over $15 at the time of this writing. That is an increase of over 30 times its original value.

Prior to 1933, you could exchange a $20 bill for a $20 gold coin containing roughly one ounce of gold. Today, an ounce of gold is selling at well over a $1,000 an ounce. This is an increase of over 50 times its original value. This shows what an increase in the money supply has done since 1932.

And it will only get worse as the Federal Government continues to ring up record high, multi-trillion dollar deficits and the Federal Reserve continues to print paper money to pay the bill. Therefore, if you cannot afford gold, you should definitely consider buying Silver Bars and Coins

HYPERINFLATION SURVIVAL GUIDE

To be a faithful steward of the money God has given you, you need to protect that money from the effects of HYPERINFLATION. You should trade paper money for gold and silver on a regular basis. This is our hyperinflation survival guide in a nutshell. See also our Suggested Links for Further Preparation (below).

Keep only enough paper dollars in the bank as you need to pay your bills. Any extra paper dollars should go into silver (and gold, if you can afford it). Later, if you need paper money, you can always sell some silver and gold for cash.

You can buy gold and/or silver coins and bars at your local coin shop or online at the link below. Don't want to store gold or silver at home? Or you want to own larger supplies in a vault?

As inflation worsens, the dollar value of your gold and/or silver will rise, offsetting the small fees for storage and administration. (Hint: It costs less to store gold than to store silver, since for the same dollar investment, gold takes up much less space than silver.)

Suggested Links for Further Preparation:

George Theiss wrote this Hyperinflation Survival Guide from a Biblical perspective. He has training and experience in both the world of finance and in the realm of theology.

He earned his Qualified Pension Administrator (QPA) designation from the American Society of Pension Actuaries in 1989, his Chartered Life Underwriter (CLU) designation from the American College in 1991 and his Master in Theology Diploma from Landmark Baptist Theological Seminary in 2004.

George Theiss is a combat veteran of Vietnam who now follows the Lamb of God. He and his wife, Christy, have been married 42 years (in 2019). They have 8 grown children. You can contact George at support@tulipgems.com

Copyright © 2002 through 2019 by George Theiss